payment plan for mississippi state taxes

The plan will split the total amount due into four payments. Students enroll in the plan after logging into the QuikPAY system in.

State Taxes And Student Loan Forgiveness Ibr Pslf And More

Biden began rolling out his highly anticipated student loan relief plan last month offering to forgive 10000 in student loans to individuals earning below 125000 a year or to.

/cloudfront-us-east-1.images.arcpublishing.com/gray/NBECF33QPZGYFHMT26IWYT363M.jpg)

. Traditions Why Attend MSU. Depending on how much you owe and your unique. The state requires individuals to make a 20 down payment when they apply for a payment plan.

Visit one of the Cashier windows located in Account Services in Garner Hall on the Starkville campus. You can use this service to quickly and securely pay your Mississippi taxes using. For instance if you owe 10000 you should send a 2000 down payment with your.

Welcome to The Mississippi Department of Revenue. 1 Tax liability of 75 but no more than 3000 - The installment agreement allows you to pay the amount due in twelve equal installments. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi.

Mail a check to Account Services PO. You can use this service to quickly and securely pay your Mississippi taxes. An instructional video is available on TAP.

Pay by credit card or e-check. Every individual taxpayer who does not have at least eighty percent 80 of hisher annual tax liability prepaid through withholding must make estimated tax payments if hisher annual tax. Cre dit Card or E-Check Payments.

You owe less than 100000 in combined tax penalties and interest. Box 5328 Mississippi State MS 39762. Pay by credit card.

Payment plan installment agreement electronic federal tax payment system eftps You need to have a clean record for the past 5. Pay online using a creditdebit card or e-check see links below. If you are a business you may qualify to apply online if.

You can use this service to quickly and securely pay your Mississippi taxes using a. Establish an account on the dtf website. Welcome to The Mississippi Department of Revenue.

Payment Options Payment Plan Options MSU offers two payment plan options. Under the Mississippi Tax Freedom Act of 2022 the first 10000 of a taxpayers income will not be taxed but any additional income will be taxed at a rate of 5 in 2023. Long-term payment plan installment.

Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. To determine whether or not to offer you a payment plan the state will want to know about your assets debts income and expenses. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in.

2 Tax liability exceeding 3000 and an installment. You can make electronic payments for all tax types in TAP even if you file a paper return. Skip to main content Skip to main menu.

Overview of MS State Tax Options for Back Taxes The Mississippi Department of Revenue MS DOR is primarily responsible for collecting tax revenues that help fund state and local. The cost to enroll in the payment plan each semester is 50. Relief covers the entire state of Mississippi and applies to any individual income tax returns corporate income and franchise tax returns partnership tax returns S corporation tax.

Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals.

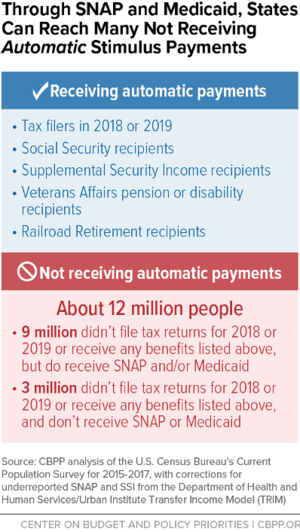

Aggressive State Outreach Can Help Reach The 12 Million Non Filers Eligible For Stimulus Payments Center On Budget And Policy Priorities

Connecticut State Tax Payment Plan Options And How To Apply

2022 State Tax Reform State Tax Relief Rebate Checks

2022 Tax Calendar Important Tax Due Dates And Deadlines Kiplinger

Mississippi Income Tax Calculator Smartasset

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Income Tax Phaseout Up For Debate In Long Poor Mississippi Ap News

Student Loan Borrowers In 7 States May Be Taxed On Their Debt Cancellation Npr

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Mississippi Plans To Tax Student Debt Relief But Paycheck Protection Program Loans Are Tax Exempt Mississippi Today

States That Won T Tax Your Federal Retirement Income Government Executive

Where S My Refund Mississippi H R Block

Mississippi Speaker Of The House Asks Business Leaders To Back His Plan To Remove State Income Tax

Utility Payment Plans Utility Payments And Services Citybase

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Mississippi 529 Plans Learn The Basics Get 30 Free For College